The European credit transfer (SEPA Credit Transfer) and the European direct debit (SEPA Direct Debit) were introduced in 2008 and 2009 respectively. The European Commission (EC) and the European Parliament believed this implementation was happening to slowly and prepared legislation in 2010 to legally regulate migration.

In 2012, the final version of the EU regulation was adopted by the European Parliament and thus came into force and is binding for 36 countries. It lays down requirements for the entire payment chain, i.e. from customer to customer.

Following on from our previous article on the introduction of the new SEPA XML version 2019, which will be available from 17 March 2024, this article provides additional information on the technical background of the European SEPA legislation.

SCOPE

The following payment products are within the scope of the EC legislation:

- Non-urgent cashless euro transfer products

- Euro direct debit products

The following payment products do not fall within the scope of EC legislation:

- Urgent payments

- Cashless non-euro transfer and collection products

- Debit and credit card payments

- Non-cash payment products (e.g. cheques)

Accessibility of payment transactions

Companies must take into account the foreign account numbers of their customers and suppliers:

- A payer making a euro payment may not dictate in which EU country the beneficiary of the payment must hold their account. Business customers must therefore bear in mind that euro payments can be made to all countries of the SEPA area.

- A debt collector that executes a direct debit may not stipulate the EU country in which the debtor must hold its account. Business customers must therefore take into account that direct debits can be carried out in all countries of the European Union.

RIghts of the parties that have been collected

A debtor is given the option by his bank to:

- Limit direct debit orders to a certain amount and/or frequency

- Block all direct debit orders

- Block direct debit orders from specific collectors

- Allow direct debit orders only from specified collectors (so-called 'whitelist' option)

How does the European transfer process work?

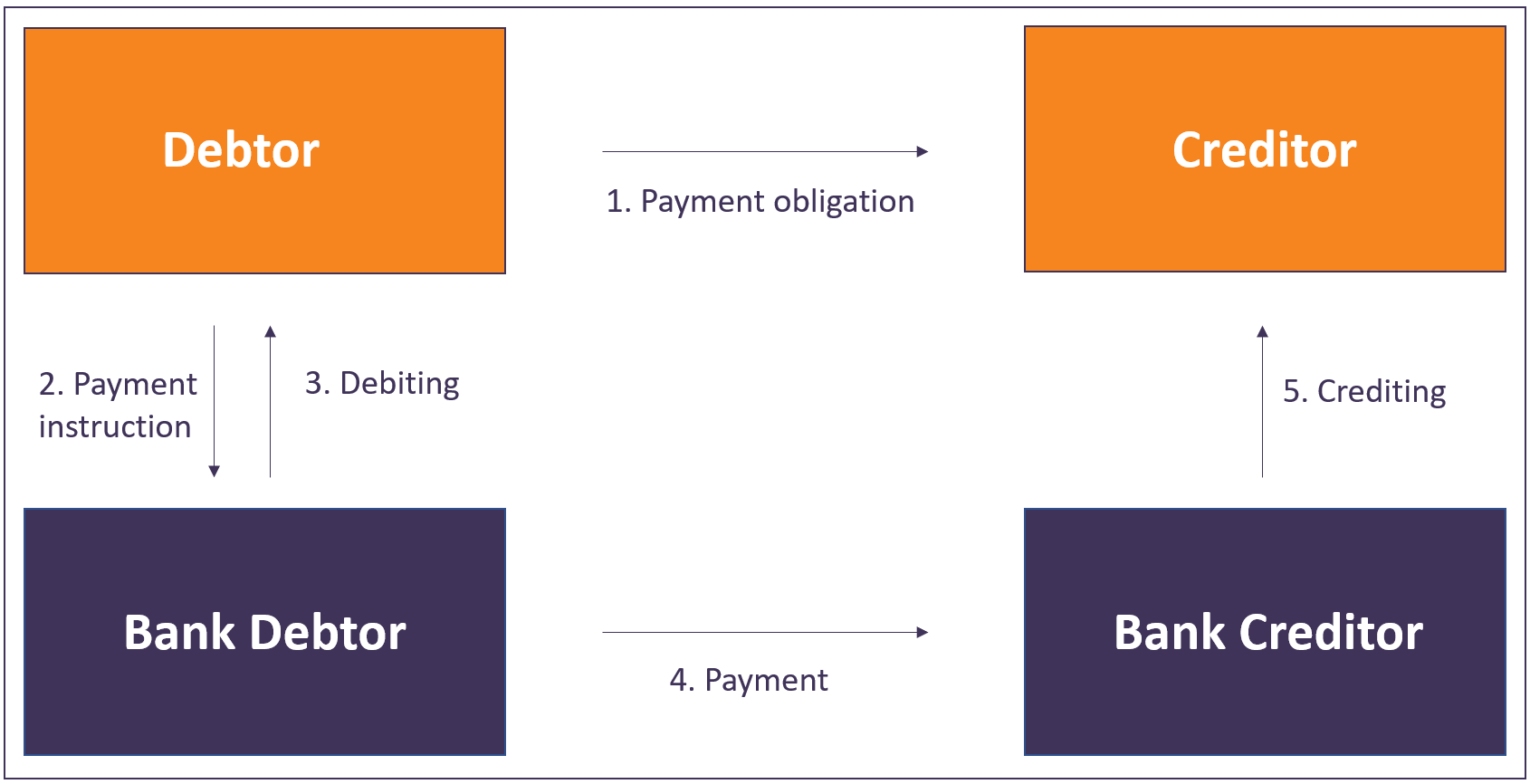

The European credit transfer process involves 4 parties: the debtor (buying party), his bank (debtor bank), the creditor (beneficiary) and his bank (creditor bank). This is also known as the 4-corner model.

*The original version of this table can be found here.

Transfer Process

The European credit transfer process consists of the following steps:

- The debtor has purchased a product or service from the creditor and therefore has a payment obligation to the creditor.

- The debtor sends a payment order to his bank with the request to debit the specified amount from his account to transfer this amount to the creditor.

- The debtor's bank checks the payment order and also checks whether the debtor has sufficient funds in his account to execute the order. If this is the case, the amount is debited from the account and the debtor is informed of this with their daily statement.

- The debtor's bank then forwards the payment to the creditor's bank, possibly via a Clearing House. The payment is then processed between the banks.

- After receipt of payment, the creditor's bank credits the received amount to the creditor's account. The creditor is informed about this via his daily statement.

How does the European Direct Debit process work?

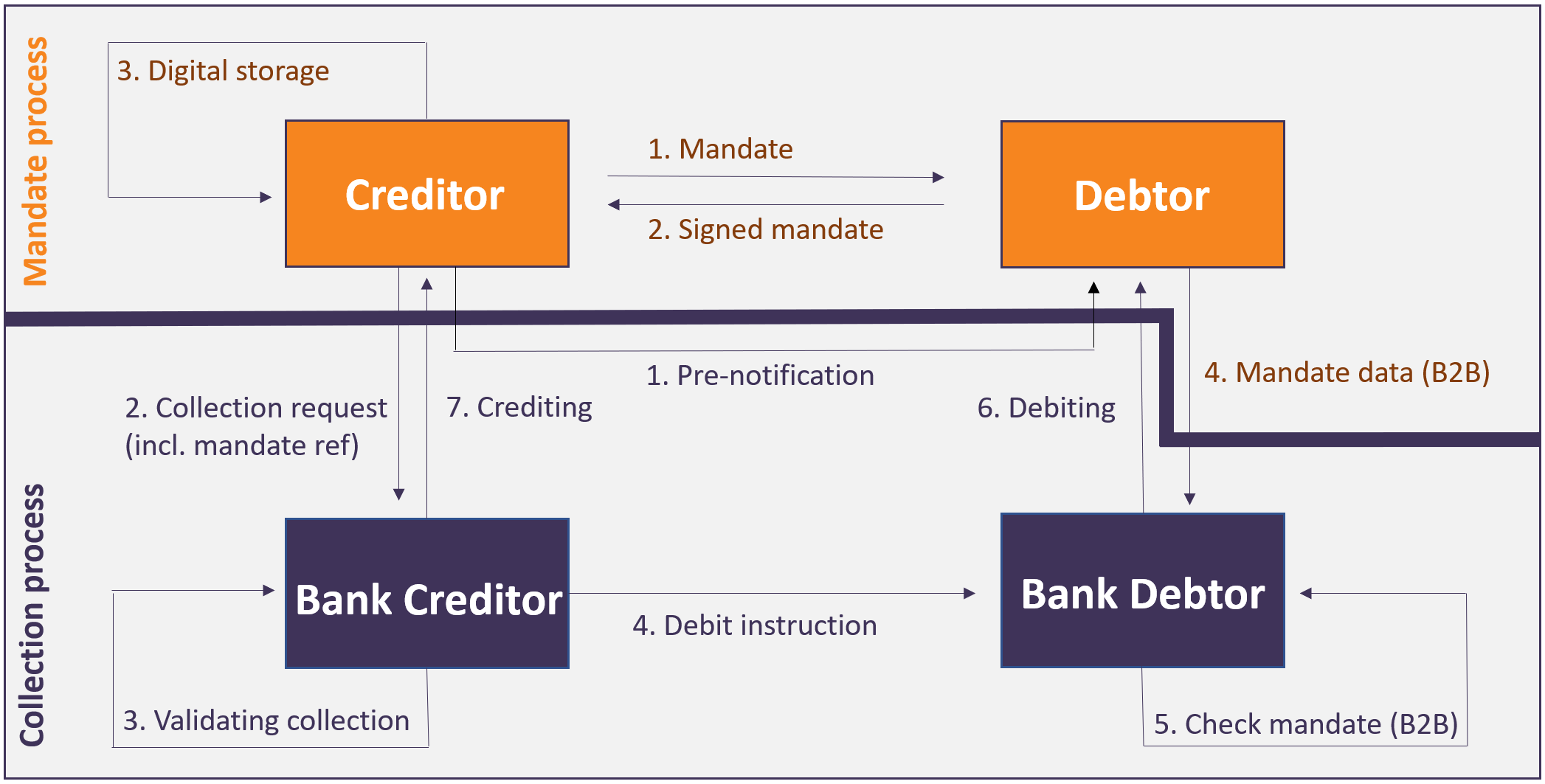

Four parties are involved in the European direct debit procedure: the creditor (collector), his bank (creditor bank), the debtor and his bank (debtor bank). This is also called the 4-corner model. The collection process consists of two parts, namely the mandate process and the collection process.

*The original version of this table can be found here.

Collection process

The collection process consists of the following steps (the handling of exceptional situations is not taken into account):

- The creditor sends the debtor a so-called “pre-notification” (advance notice) at least 14 days before the collection is carried out, informing his debtor of the amount to be collected and the date of collection. The collector can use existing documentation, such as the invoice, for this purpose. In case of a recurring direct debit collection, it is also possible to send a preliminary notice with a collection schedule for a specific period before the first direct debit is made.

- With a normal direct debit, the creditor shall send the direct debit order to his bank no later than 5 (for a first continuous or one-off direct debit) or 2 (for a subsequent continuous direct debit) working days before the direct debit date.

For a business collection, this is in all cases no later than 1 working day before the collection date. The direct debit order contains the details of the authorization issued. - The creditor's bank receives the collection order and validates it. The bank also checks whether the creditor has a valid contract for the type of direct debit submitted (normal or business direct debit).

- The bank then forwards the collection order to the debtor's bank, possibly via a clearinghouse.

- In the case of a business direct debit, the bank compares the authorization data sent with the direct debit order with the authorization data provided by the debtor. If these do not match, or if no authorization is known, the bank will not carry out the collection.

- On the collection date, the bank charges the debtor's account with the amount to be collected. The debtor is informed about this via his daily statement.

- After interbank settlement, possibly via a clearinghouse, the creditor's bank credits the amount collected to the creditor's account, after which the creditor is informed about by means of his daily statement.

Mandate process

The European direct debit also offers the option to initiate and have an authorization signed digitally. This is called an e-mandate.

The mandate process has the following steps:

- The creditor (collector) offers the debtor an authorization for a European direct debit (mandate) for signature. This can be done in various ways, for example as part of a paper invoice or as an electronic file (pdf).

- If necessary, the debtor prints out the authorization and enters their name and address details as well as their account number (IBAN) and, if applicable, the BIC of their bank. The debtor then signs the authorization and returns it to the creditor.

- The creditor archives the authorization and records the authorization data electronically (mandate management system).

- With the European business direct debit (B2B scheme), the debtor also sends a copy of his signed authorization to his own bank, or informs his bank of the authorization in another agreed manner. The bank stores the details of the mandate and will validate every direct debit received against these details to rule out possible fraud. The debtor has no right of reversal for this type of collection.

what are the requirements for managing authorizations?

Creditors are obliged to physically archive the authorizations for the European direct debit and keep them for the legally required period. A collector must be able to provide the debtor with a copy of the authorization on request. In addition, part of the data of each authorization must be stored electronically. The reason for this is that this authorization information must be sent with every direct debit order.

Exceptions in SEPA transfers

Exceptional situations are handled using the so-called R-Transaction. The ‘R’ stands for the type of exception, such as ‘Reject’ and ‘Refund’.

| R-Transactions | European Transfer | Direct Debit |

| Request for cancellation | ||

| Cancelling before a scheduled transfer | Complete payment batch; Item(s) from a payment batch; Individual transfer |

Complete collection batch; Item(s) from a payment batch |

| Timeline; | 1 day before transfer |

Normal; 5 days before first transfer; Normal; 2 days before subsequent transfer B2B; 1 day before transfer or same day |

| Communication; | Procedural depending on bank; Bank's Internet Portal; Submitting an electronic cancellation order (Camt.055) |

Bank's clients service department; Bank's Internet Portal; File (Camt.055) |

| Recall (revocation of transfer) | ||

| Mostly attempted by clients bank | Double sending of transfer by bank; Technical problems and incorrect transfer; Fraudulently transfer |

Double sending of transfer by bank; Technical problems and incorrect transfer; |

| Timeline; | Up to 10 working days after transfer; Followed by 10 working days beneficiary's bank |

Up to 2 days after transfer |

| Communications; | Bank's client service department |

Bank's client service department; Bank's Internet portal; Submitting an electronic repair order (Pain.007) |

| Rejection | ||

| By own bank before execution | Complete payment batch; Individual transfer |

Complete collection batch; Individual transfer |

| Timeline; | From submission to day of transfer | From submission to day of transfer |

| Communication; | Procedural depending on bank; Refund the day after on daily statement; Returning an electronic payment status report (Pain.002) |

Bank's client service department; Refund the day on daily statement; Payment status report (Pain.002) |

| Return (return payment) | ||

| After transfer is executed | Beneficiary account number unknown; Transfer not allowed for specific account nr |

Debtor's account number unknown; Insufficient debtor balance |

| Timeline; | Max 3 working days after transfer; If approved max 20 days for return |

Normal: 5 working days after collection; B2B: 2 working days after collection |

| After transfer is executed | ||

| At request debtor | Authorization direct debit; | Not applicable |

| Timeline; | Up to 8 weeks after date of debit | |

| At request debtor | Unauthorized direct debit; | |

| Timeline; | Max 13 months after date of debit |

*The table is based on information on R-Transactions relating to European Transfer and Direct Debit.