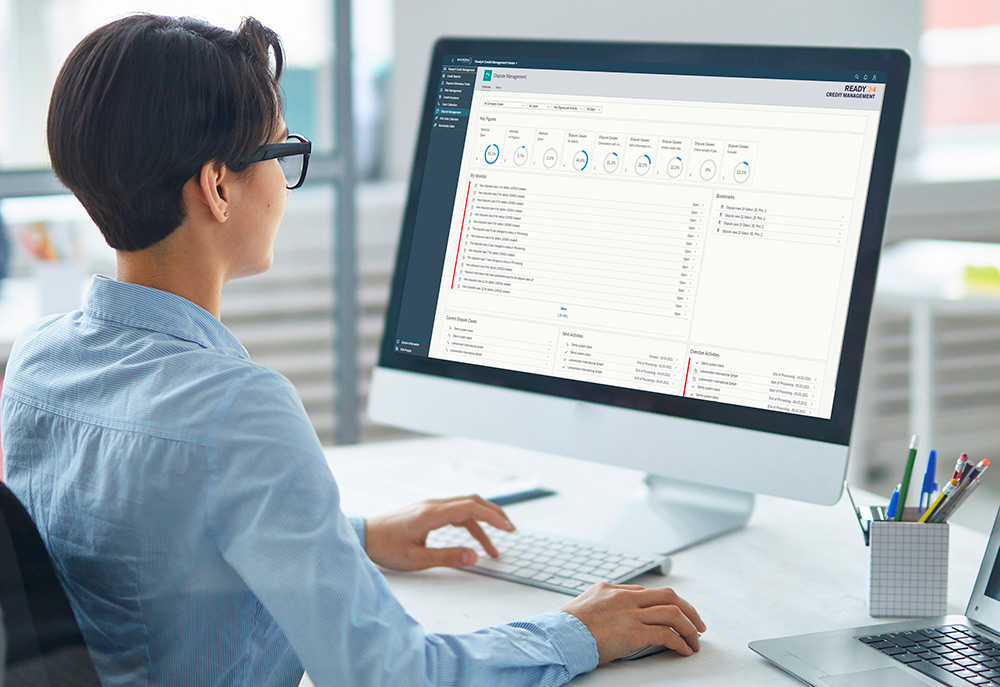

Save time on credit risk assessments with process automation and gain access to real-time information.

It is becoming more & more important for companies to be able to do faster and more accurate credit assessments. By automating your manual credit risk actions you will improve efficiency, minimise errors as well as save time & operational costs