The SEPA XML version 2019 will be available from March 17, 2024. This new version comes, at least for the time being, in addition to the current version from 2009. The new version offers some new options , of which structured address information is the most important.

In addition to the name (Nm), it is always mandatory to provide the fields of place of residence (TwnNm) and country (Ctry). The rest of the fields are used if this applies to the correct interpretation of the address. For example, the building name (BldgNm) will not be used that often.

The new SEPA XML version 2019 is the result of European regulations and further standardization of payment transactions. Banks will continue to support the old 2009 version until November 22, 2025. After that, banks may decide to phase out the XML version 2009. Your bank will inform you in a timely manner if this is the case.

Take the software adjustment into account now

The adjustment to SEPA XML version 2019 is easy to implement in your software and/or financial systems. The advice is to plan software adjustments to the new SEPA XML version 2019 now. If you have any questions, you can contact the SOA People Group in the respective country.

This also means making preparations to store address information in a structured manner in administration systems if the opportunity arises. Then you or your customers are prepared for the future and payments can be sent or received without any worries.

Timeline

| Version | Current | As of March 17, 2024 | As of November 22, 2025 |

| XML 2009 | Possible (default) | Possibly | Possible (but individual banks can phase this out in the long term) |

| XML 2019 | Not possible | Possibly | Possible (default) |

| Outside EEE* | Address information may be structured or unstructured | Address information may be structured or unstructured | Address information must be structured |

* Providing address information is not mandatory within the EEA. Ask your bank what you can do best if you provide this information now. The original table can be found here.

So what is SEPA?

SEPA stands for Single Euro Payments Area and primarily concerns cashless payment transactions, payments with payment cards and credit cards, and the interbank payment systems that make these payments possible. Since March 2019, 36 countries have been part of the SEPA area, including some non-euro currency areas and non-EU countries.

Remark: also the first steps towards harmonization of mobile payments have already been taken.

What possibilities does SEPA offer?

SEPA offers the business market a number of options that can deliver significant cost savings.

For example: centralization of accounts

Companies can reach the entire SEPA area for their transfers and direct debits from one account. This can significantly reduce the number of banking relationships and bank accounts, especially for internationally operating companies. It provides benefits for a company's cash management by a significant reduction in complexity (fewer bank interfaces, unification of reconciliation, etc.) and cost savings for a company.

SEPA has two payment methods:

- the European Transfer

- the European Direct Debit

What is a European Transfer?

With the European Transfer (also known as SEPA Credit Transfer), business parties and consumers can make euro payments, without making a distinction between domestic payments and cross-border payments to other SEPA countries. So for example, the European Transfer makes it just as easy to pay euros to a local bank account as to an account at a foreign bank.

- This can be done from any checking account at a bank in the SEPA area.

- You may not refuse a payment from a foreign checking account.

- Your bank must pass on the payment reference you provided, or the notifications provided by the payer, to you unchanged.

In many cases, this simplifies reconciliation with outstanding invoices and can be carried out automatically.

- SEPA uses an universal standard ISO 20022 for messages in financial messaging, such as in payment transactions.

- XML (eXtended Markup Language) is the standard for the structured recording of data of various types.

- Accounts in the payment order are identified using IBAN (International Bank Account Number, identifying the country, bank and specific account number). For cross-border payments, your bank often also asks you to provide the BIC (Bank Identifier Code), a standardized identification system of financial institutions. In the Netherlands BIC is not applicable.

- The so-called “Creditor reference” is based on an ISO standard (ISO 11649) that minimizes the risk of incorrect input through the built-in

How Does the european transfer work?

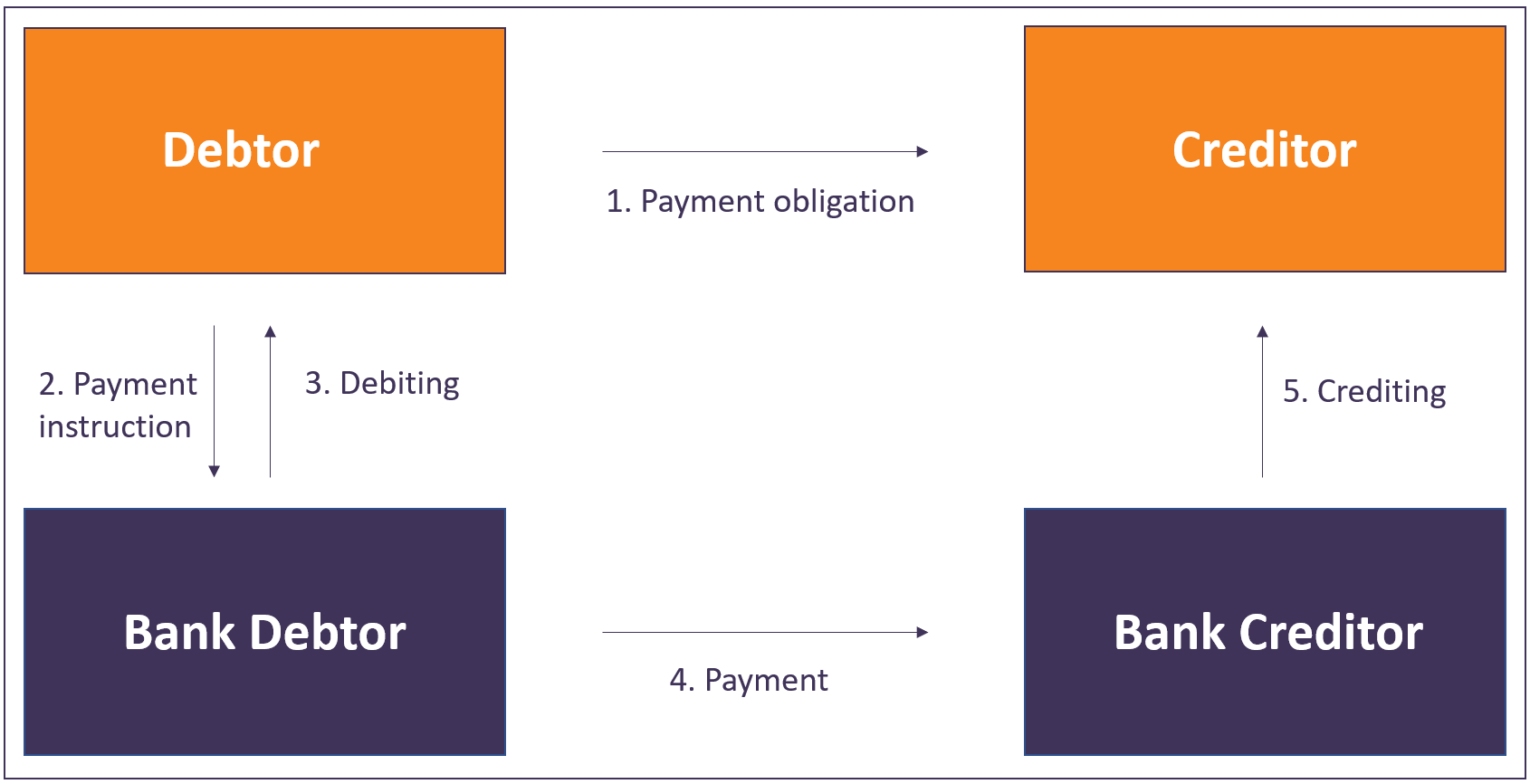

The European credit transfer process involves 4 parties: the debtor (principal), his bank (debtor bank), the creditor (beneficiary) and his bank (creditor bank). This is called the 4-corner model.

*the original version of this table can be found here.

What is a European Direct DeBit?

Besides transfers, the European Direct Debit (SEPA Direct Debit) can be used. This enables business parties to collect euro amounts from account holders at all banks in the SEPA area, whereby uniform agreements apply to the debtor's authorization. The collector can initiate these direct debits from any bank in the SEPA area and is therefore no longer bound to a separate bank and direct debit account per country where collection takes place.

Naturally, you must conclude a direct debit contract with the relevant bank for this and you should monitor the final period for presentation of the direct debit order. The debtor must of course have given you authorization for this. This can be done in various ways, but is subject to strict rules. The European direct debit also offers the option to initiate and have an authorization signed digitally. This is called an e-mandate.

In addition, you must notify the debtor of the collection in advance (the so-called pre-notification). Various rules have been agreed on for this at banking level.

You must always administer and store authorizations for the European Direct Debit yourself and you must supply some key details of the authorization with every direct debit order. This also applies to any changes to the authorization.

How does the European Direct Debit work?

The European direct debit process involves the same 4 parties (4-corner model) with addition of the collection process that consists of two parts, namely the mandate process and the collection process.

Different features apply to business direct debits (B2B) and normal (Core Business)

The European direct debit has two schemes, the normal direct debit (core scheme) and the Business to Business (B2B) scheme called business direct debit. The overview below shows the most important differences between these schemes:

| Characteristic | Business direct debit (B2B scheme) | Normal direct debit (Core scheme) |

| Debtor of the collection | Always has to be a business | Can be both a company and a consumer |

| Delivery time of the direct debit | No later than 1 working day before the collection date | No later than 5 working days before the collection date |

| Reversal of rights for the debtor | Cancellation is not possible for the debtor | Debtor can have the direct debit reversed up to 8 weeks after the collection date without giving a reason. |

| Authorization for direct debit | The debtor is obliged to provide a copy of the authorization to his bank before the first collection takes place. The debtor's bank will check every direct debit received for this authorization against the data from the copy of the authorization | Debtor does not have to provide a copy of the authorization to his bank. Existing authorizations for recurring direct debits can in principle be reused |

*The complete overview of the two schemes can be accessed here.

If you are also interested in the technical background to the European SEPA legislation, you can take a look at our article "A closer look at the European SEPA legislation".