Poor creditworthiness and customer defaults can seriously damage your cash position, especially on products with low profit margins.

Wouldn’t it be good if you could avoid out-of-stock situations ahead of sales forecasting by having accurate inventories of your goods? And wouldn’t it be even better if you could credit check your sales pipeline as part of your inventory management and before signing off on a sales deal?

Why businesses use inventory management

Businesses like distributors and wholesalers use inventory management to plan warehouse storage and maintenance of raw materials and finished goods in order to meet demand and minimise the expenses associated with keeping stock. But they can only succeed if they can supply their goods to their customers at the right time. To protect sales they often maintain a larger inventory than necessary, protecting themselves against unexpected changes in demand and supply in their changing and volatile markets.

Inventory management procedures are increasingly used to forecast demand and future sales by improving efficiency, tracking income and expenses, and selling prices.

4 ways credit management techniques helps you manage inventory

- Ensures the right finance happens before a deal is closed

- Helps to offer shorter delivery times and better payment terms

- Checks and monitors creditworthiness using payment experience pools, international credit bureaus and trade credit insurers to detect any default risks before any delivery and invoice reaches the customer.

- Monitors production and stock availability for more reliable cash flow planning.

How sales forecasting helps to predict future revenues as well as pipeline sales

Credit reports help you make credit decisions and assess your requirements for future stock levels based on the solvency of your prospects. They mitigate the risk of manufacturing, purchasing or storing too many goods which could disrupt your cash flow and in the worst case scenario cause loss of inventory value or stock obsolescence.

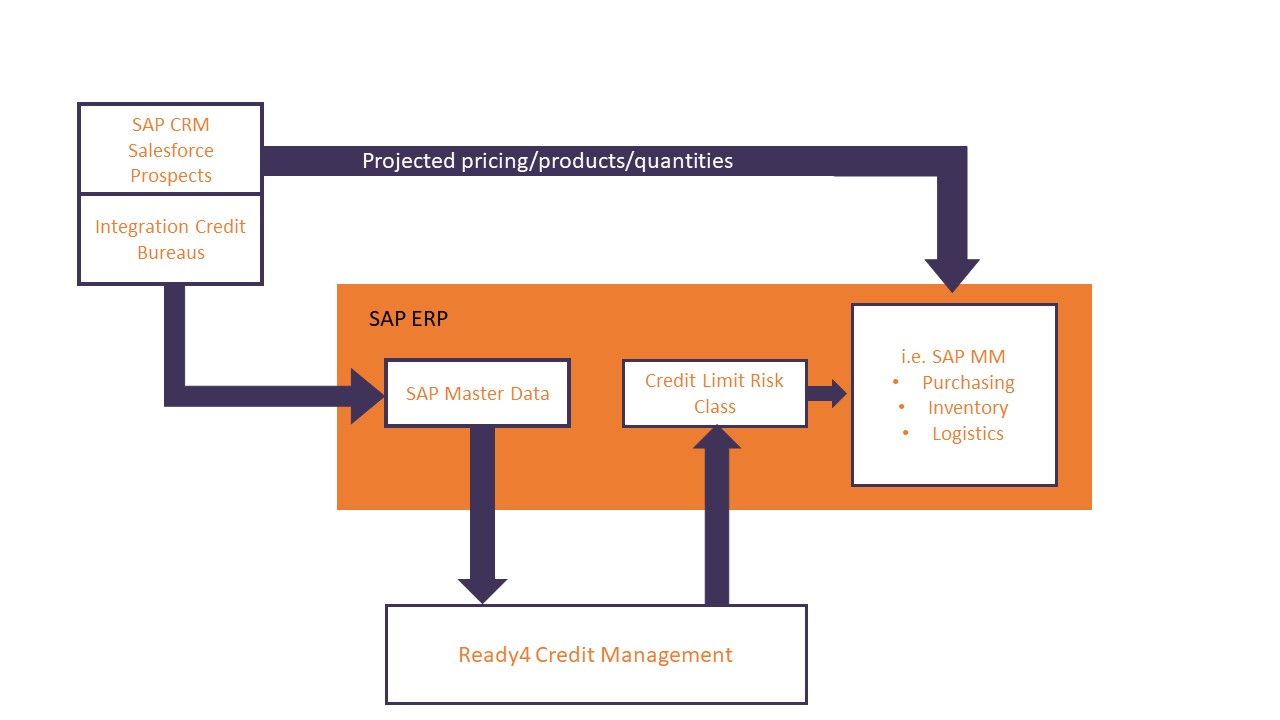

Sales forecasting can be integrated into our SAP Credit Management Suit, Ready4 Credit Management, allowing your sales people to assess the creditworthiness of potentially major revenue prospects and existing customers to plan further purchase and inventory activities, focusing on reliable and revenue-worthy deals.

The benefits of using early credit checks

- Ensures your sales pipeline has enough creditworthiness and estimated credit limits to fulfil future payment obligations. This protects the value of your inventory and your revenues.

- Supports your purchasing and inventory control strategies, as credit data on new and existing customers is more reliable allowing you to accurately order the manufacturing, replenishment or purchase of goods.

- Net product margins can also be considered at an earlier stage to define inventory priorities by running an ABC Analysis. This lets you focus both on products that bring the larger part of net incomes and those ones that are best sellers with any margin, thus avoiding out-of-stock situationandassuring customer satisfaction.

- You can offer more credit to your creditworthy prospects and customers as well as competitive payment terms and optimize storage space for more lucrative products, while assuring a cash-covertible inventory.

Why use SAP Credit Management for your order-to-pay

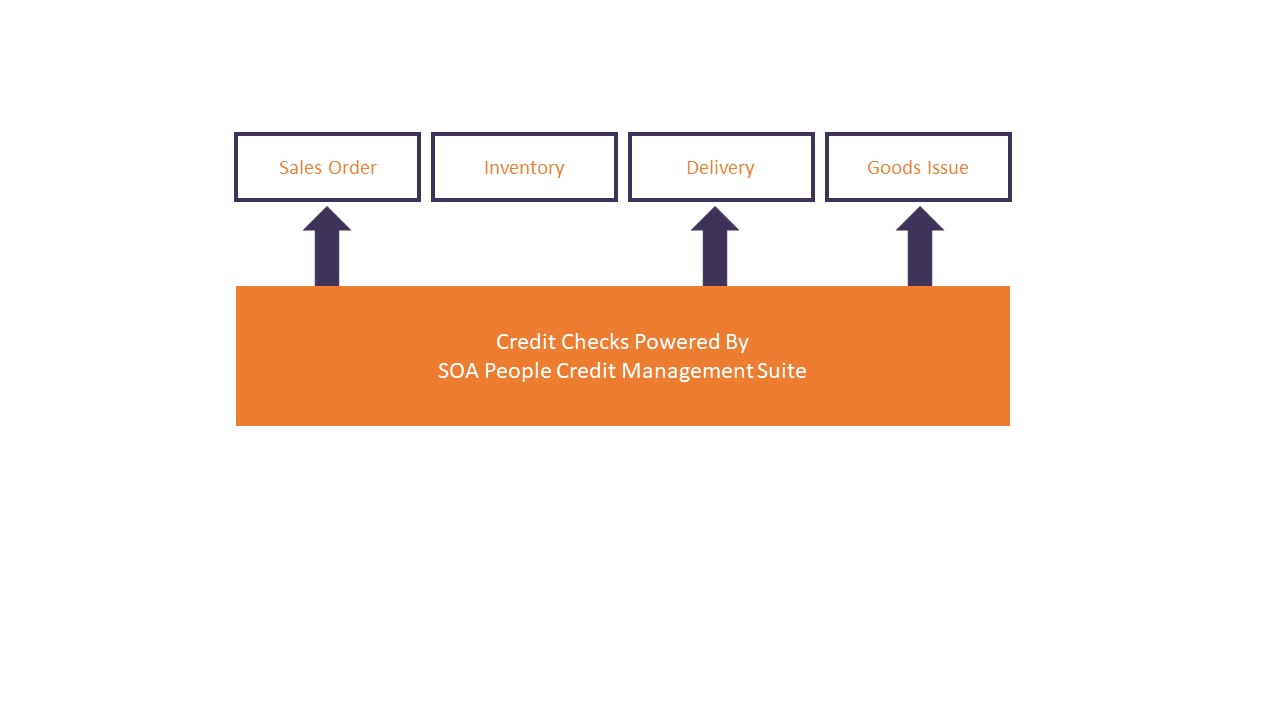

Credit management techniques powered by SAP minimise the financial risks you may incur in your day-to-day operations until delivery and invoicing takes place. With SAP you can easily monitor your customers‘ credit availability during the order-to-pay process.

Single point of contact for credit bureaus

SOA Peoples‘ Credit Management Suite, a dynamic SAP Platform, is a single point of contact to international credit bureaus such as Bisnode/D&B, Creditsafe, Creditreform, CRIF/Skyminder, major trade credit insurers Euler Hermes, Atradius and Coface and factoring institutions such as BNP Paribas and Eurofactor.

Seamless integration into your finance processes

Integrate all your corporate finance, accounting and sales and distribution processes.

Monitor changes during order-to-pay

Facilitate credit checks during your entire order-to-cash process by monitoring changes in customer’s payment behaviour, revenue trends, outstanding debts and external credit information.

Define your threshold values

Depending on order types and customer profile, you can automatically block sales orders, deliveries and goods issues with free definable threshold values and specific KO criteria.

Identify customer default risks

Identify default risks by automating & monitoring creditworthiness and updating available credit limit coverage for incoming sales forecasting and credit needs. Highly configurable scorecards let you make decisions based on internal coverage and credit insurance limits, connecting SAP to trade insurers online to outsource credit risks when prospects become customers.

Protect against credit check failures

If any sales order or delivery incurs a credit check failure because of an unacceptable default risk category or credit limit excess, then the related sales order or delivery is automatically held in SAP and only authorised users can release them by entering a reason to ensure corporate compliance. As soon as the system detects an improvement in credit conditions, whether there has been an upgrade to the customer’s risk category, new collateral detected or a higher credit insurance cover, the system can automatically trigger a new credit check to release orders being held at any stage and continue with the order processing to enable delivery and invoicing, while safeguarding the cash-position at all times.